vermont state tax brackets

Each marginal rate only applies to earnings within the applicable marginal tax. Overview of Vermont Retirement Tax Friendliness.

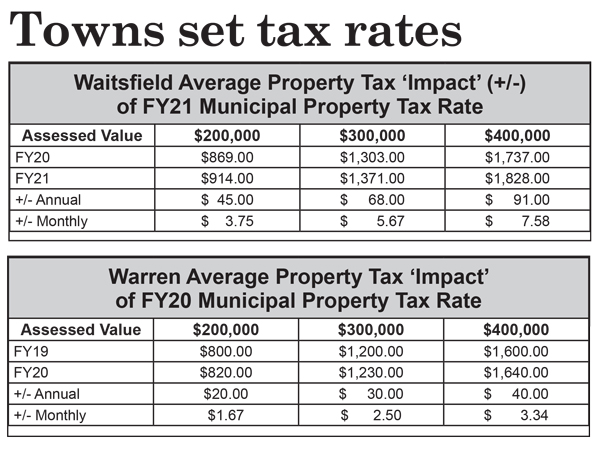

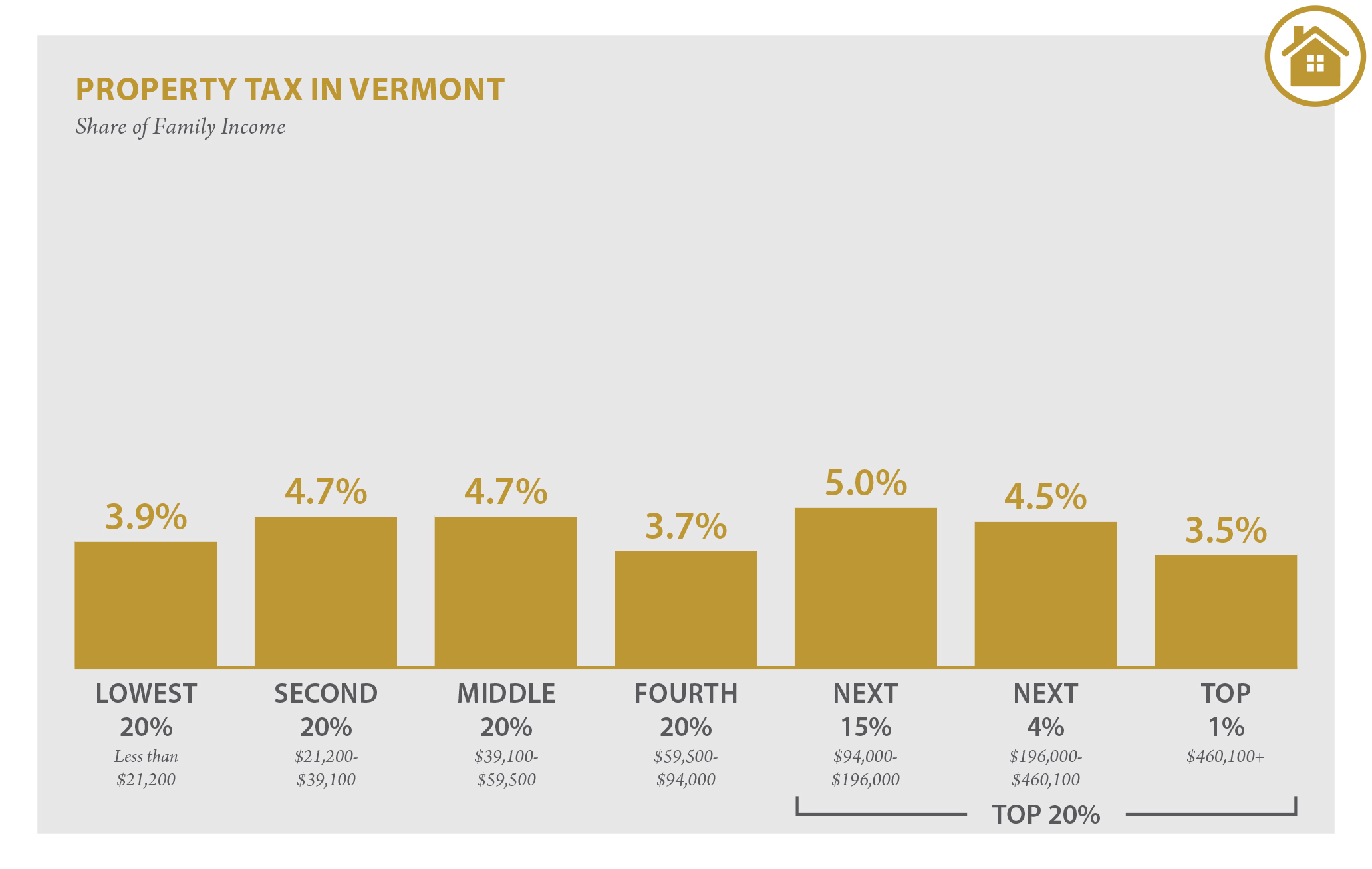

Vermont Property Tax Rates Nancy Jenkins Real Estate

This includes Social Security retirement benefits and income from most retirement accounts.

. Virginias income tax brackets were last changed thirteen years prior to 2020 for tax year 2007 and the tax rates have not been changed since at least 2001. Property taxes in Vermont are among the highest in the nation but sales taxes are below average. Wisconsins 2022 income tax ranges from 4 to 765.

Virginia has four marginal tax brackets ranging from 2 the lowest Virginia tax bracket to 575 the highest Virginia tax bracket. This page has the latest Wisconsin brackets and tax rates plus a Wisconsin income tax calculator. Income tax tables and other tax information is sourced from the Wisconsin Department of Revenue.

Vermont taxes most forms of retirement income at rates ranging from 335 to 875.

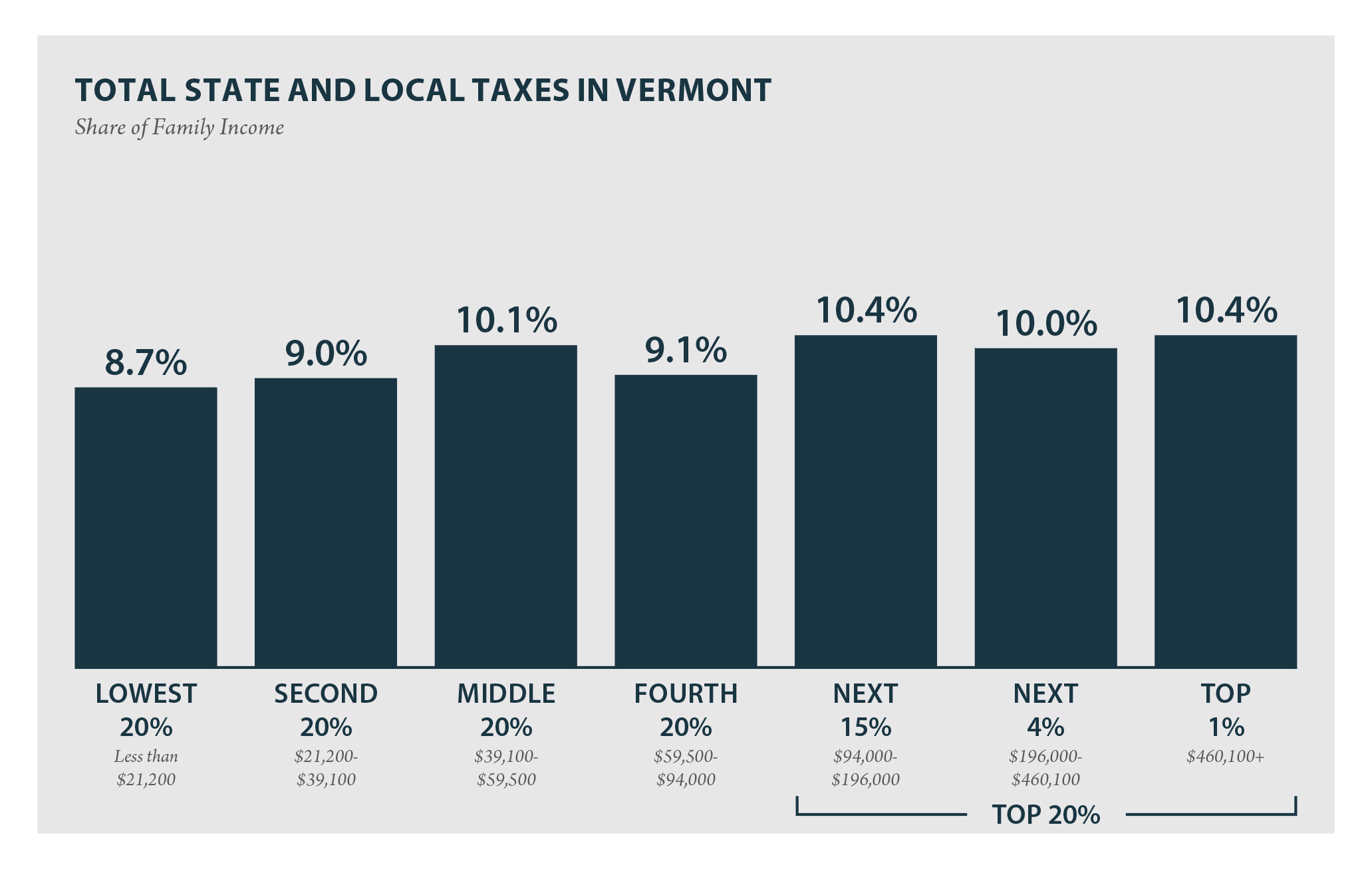

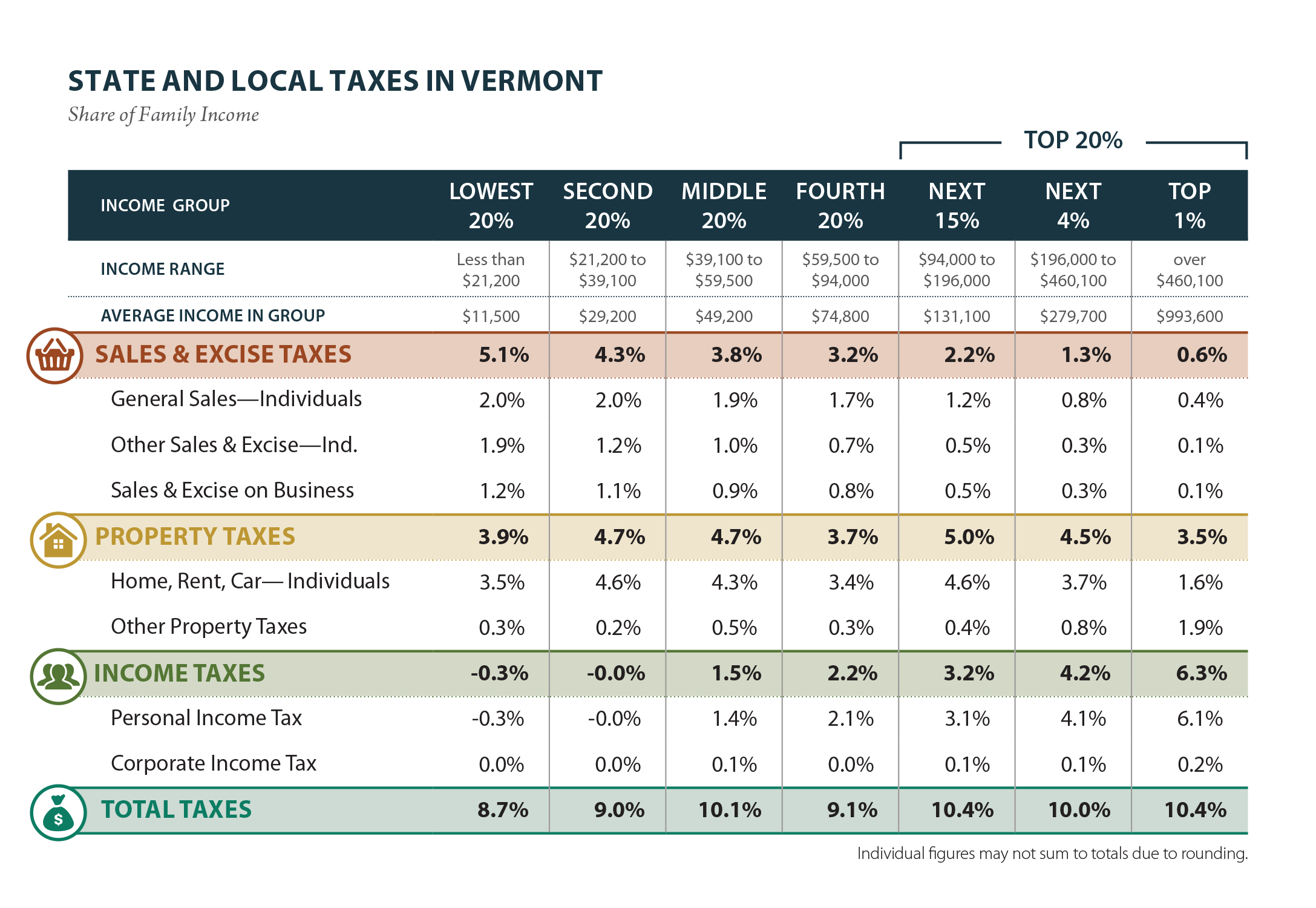

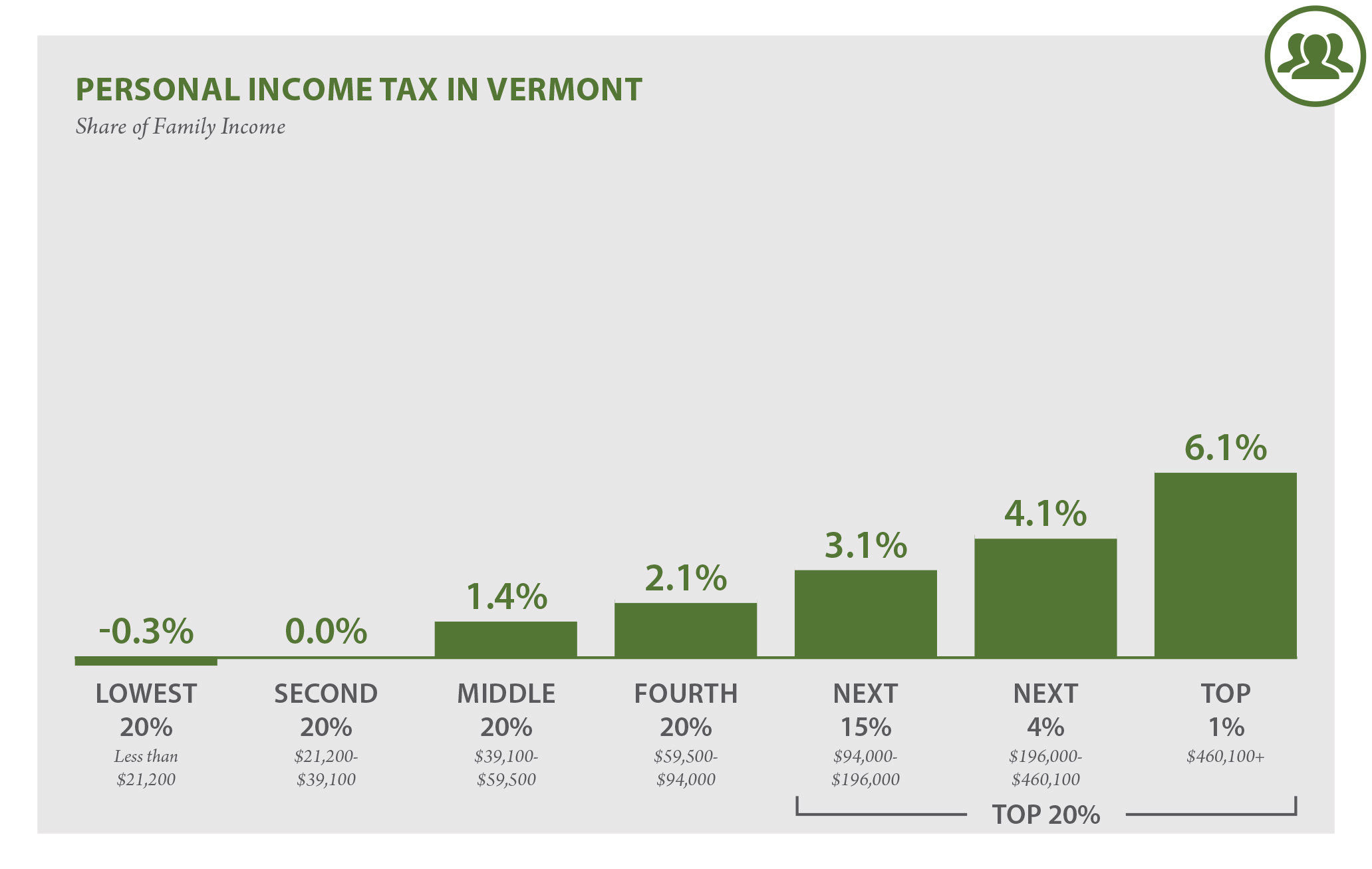

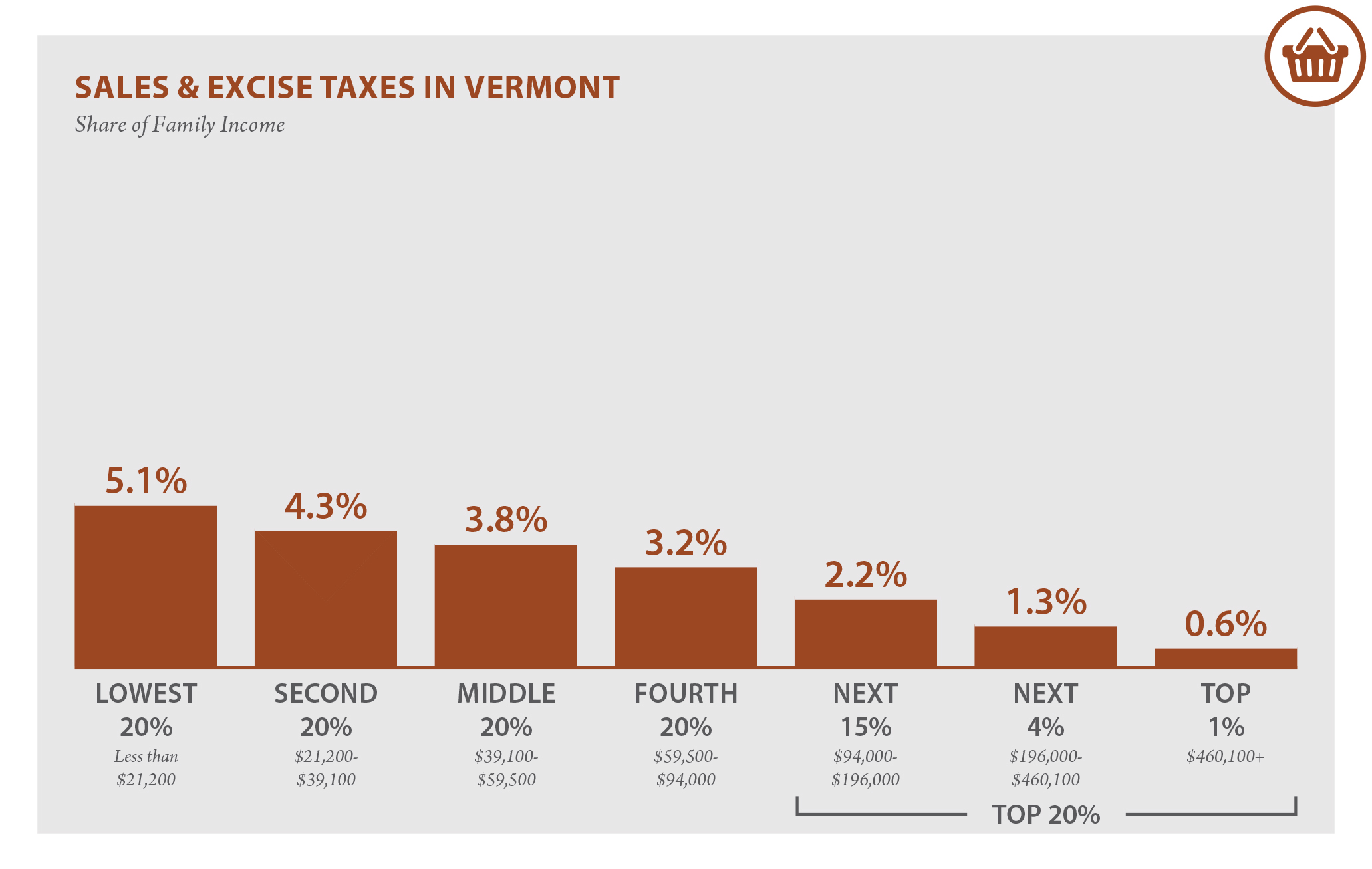

Vermont Who Pays 6th Edition Itep

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Sales Tax Small Business Guide Truic

Vermont Who Pays 6th Edition Itep

The Most And Least Tax Friendly Us States

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Historical Vermont Tax Policy Information Ballotpedia

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Vermont Income Tax Vt State Tax Calculator Community Tax

File Top Marginal State Income Tax Rate Svg Wikipedia

Where S My Vermont State Tax Refund Taxact Blog

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Who Pays 6th Edition Itep

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine